Apple will now pay $16 billion to Ireland as a tax return. Margrethe Vestager, a leader of European Commision, said that between 2003 and 2014, Ireland treated Apple generously by giving subsidy on tax bills. Also, Ireland was taken to court by European Commision last year in October. Vestager also told Ireland to collect the taxes of $16 billion by January 3. Last year, Vestager said that Ireland was not able to collect the tax from the Apple and that’s why she decided to take them to court.

She also said that we understand that tax collection can be difficult in some cases and we are always ready to assist. But there should be enough progress by the states to collect taxes.

Ireland’s Response:

According to the official statement released by Ireland Government, they are very disappointed that the European Commission has taken the case to the court.

The department of finance said in a statement that analysis presented by European Commission in this matter is not accepted by the Ireland Government. But we are making sure that the recovery of tax from Apple completed as soon as possible. And Ireland Government fully respects the decision of European Commission. But taking a country to the court, that’s what made us disappointed. Our experts are doing their best to ensure that they recover the tax from Apple as soon as possible.

The Ireland Govt Officials said that it is regrettable that commission took this decision in such a huge tax recovery. Also, the Ireland Govt said that they are very close to establishing an escrow fund with Apple.

However, in reply to these statements, Vestager said that we know that tackling such a huge amount is not as simple as it looks. The amount of tax is huge and it is very tricky to handle such amount, said Vestager while giving an interview to CNBC. This is not a minor amount of €25 million which can easily be managed through escrow, and they know that it will take some time.

Apple’s Response:

Apple Inc was asked to pay all the money by January 3 in an escrow account held by the third party. And this issue caught heat because Ireland Govt didn’t want Apple to pay the tax. And this behavior can disturb the business of other multinational companies. Back in 2016, CEO of Apple Inc Tim Cook said that they are now in an awkward position as they are asked to pay the additional tax to the government who has already said they don’t owe the tax.

The tax paid by the apple will now be held in an escrow account held by the third party. Apple will start paying the tax by the quarter of this year and the additional interest will be calculated after the whole tax payment.

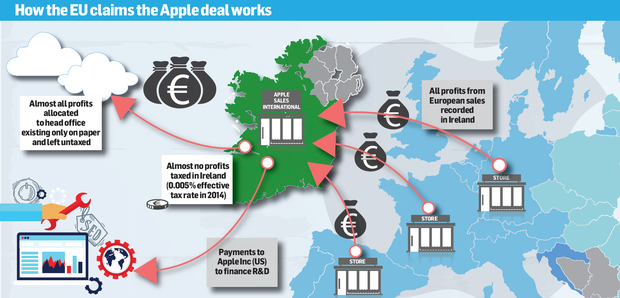

Apple published a newsletter on its official site, in which it was told that Apple is now the highest taxpayer in the United States, Ireland and in the whole world. In past few years, we tried our best to comply according to the tax laws of Ireland. And now the European Commission is rewriting Apple’s history in entire Europe without taking into account the tax laws of Ireland.

Apple was alleged to receive fringe benefits from the Irish government but Apple has bashed all these allegations saying that we never went for a deal with Ireland. Now the EC is changing the tax laws of Ireland and wants to implement the laws what they think should be. This decision will affect the authority of EU members across the whole Europe. Both the alleged parties have said to appeal against this ruling of European Commission.

It was also said by the Apple Inc that tax collection from multinational companies is complex all over the world. But still, a uniform rule is followed for tax collection. According to the rule, a company’s tax value is calculated with respect to the country where the value is created. And in Apple’s case, all the development took place in California, as said in the newsletter published by Apple back in 2016. Therefore the tax imposed on Apple should be according to US tax policies. But European Commision is now changing these rules.